States With the Most Student Loan Debt

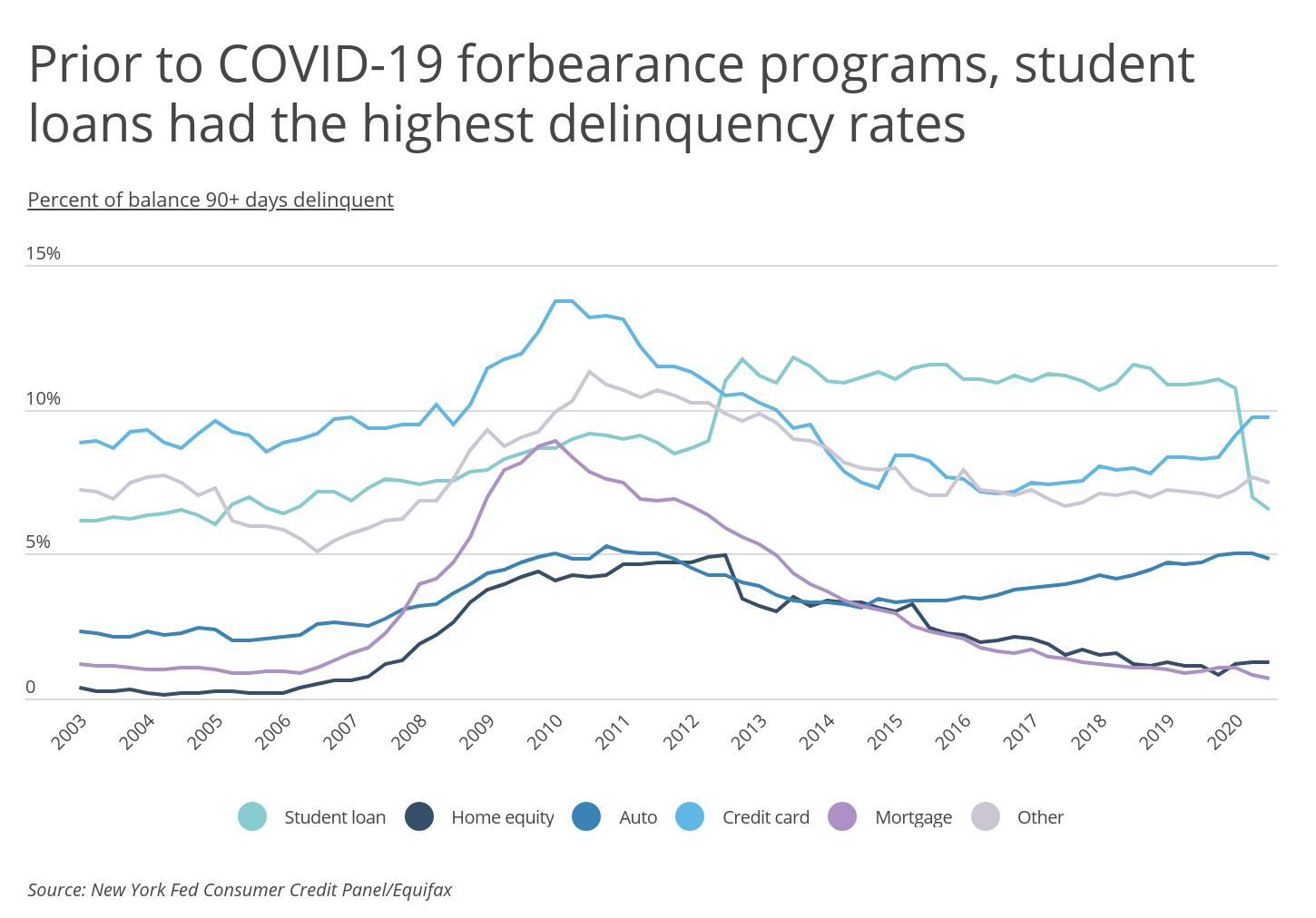

Since 2012, student loans have had the highest delinquency rate of any form of consumer debt. And while recent data from the New York Fed suggests that student loan delinquency rates have declined during COVID-19 pandemic, this data actually reflects the effect of government forbearance programs. While a large share of student loans are currently in forbearance due to COVID-19 aid programs, students-many of whom might struggle to find work in a depressed economy-will be put in a precarious situation when aid programs end. How the new administration tackles the student loan crisis will be critical for many degree holders struggling to make their payments.

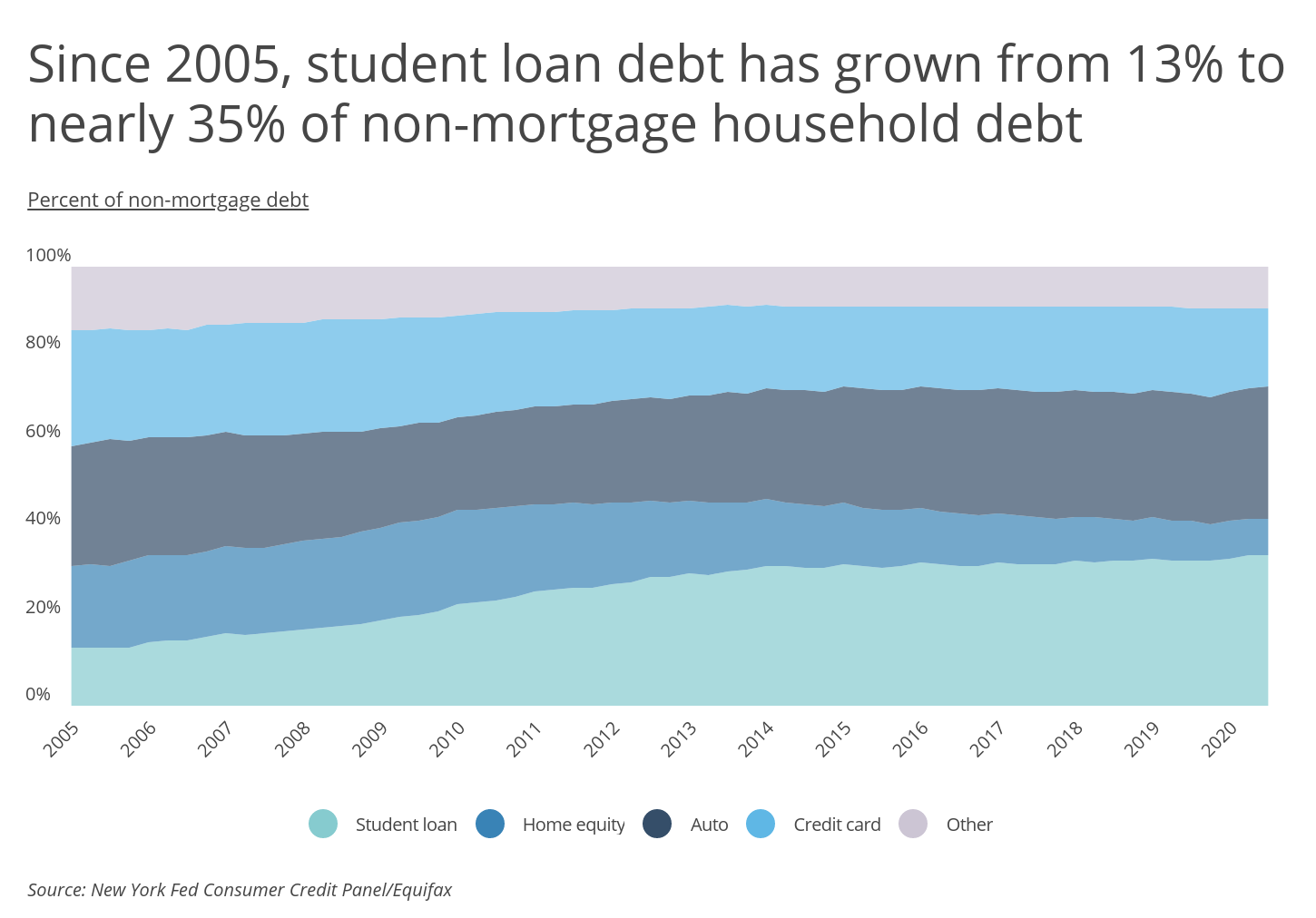

While forbearance programs keep the rate of delinquencies and the burden of student loan debt suppressed in the short term, the longer term trend shows that student loan debt has been rising steadily. Since 2005, while total household debt rose 56 percent, student loan debt grew by more than 330 percent-reaching a staggering $1.5 trillion in the third quarter of 2019. Apart from mortgages, student loans are now the largest source of consumer debt, accounting for 35 percent of non-mortgage household debt.

RELATED

Even if you have student loan debt, if you also have family members that depend on you, it’s important to be protected financially should something happen to you. The best life insurance companies can provide financial protection for your family (or dependents) for a monthly premium that won’t break the bank.

Making the situation more challenging for borrowers with student loan debt, these loans can be extremely difficult to discharge, even after filing for bankruptcy. While discharging this type of debt can be challenging, it is not impossible, and student loan debt forgiveness is a growing topic of discussion in Congress and within the Biden administration.

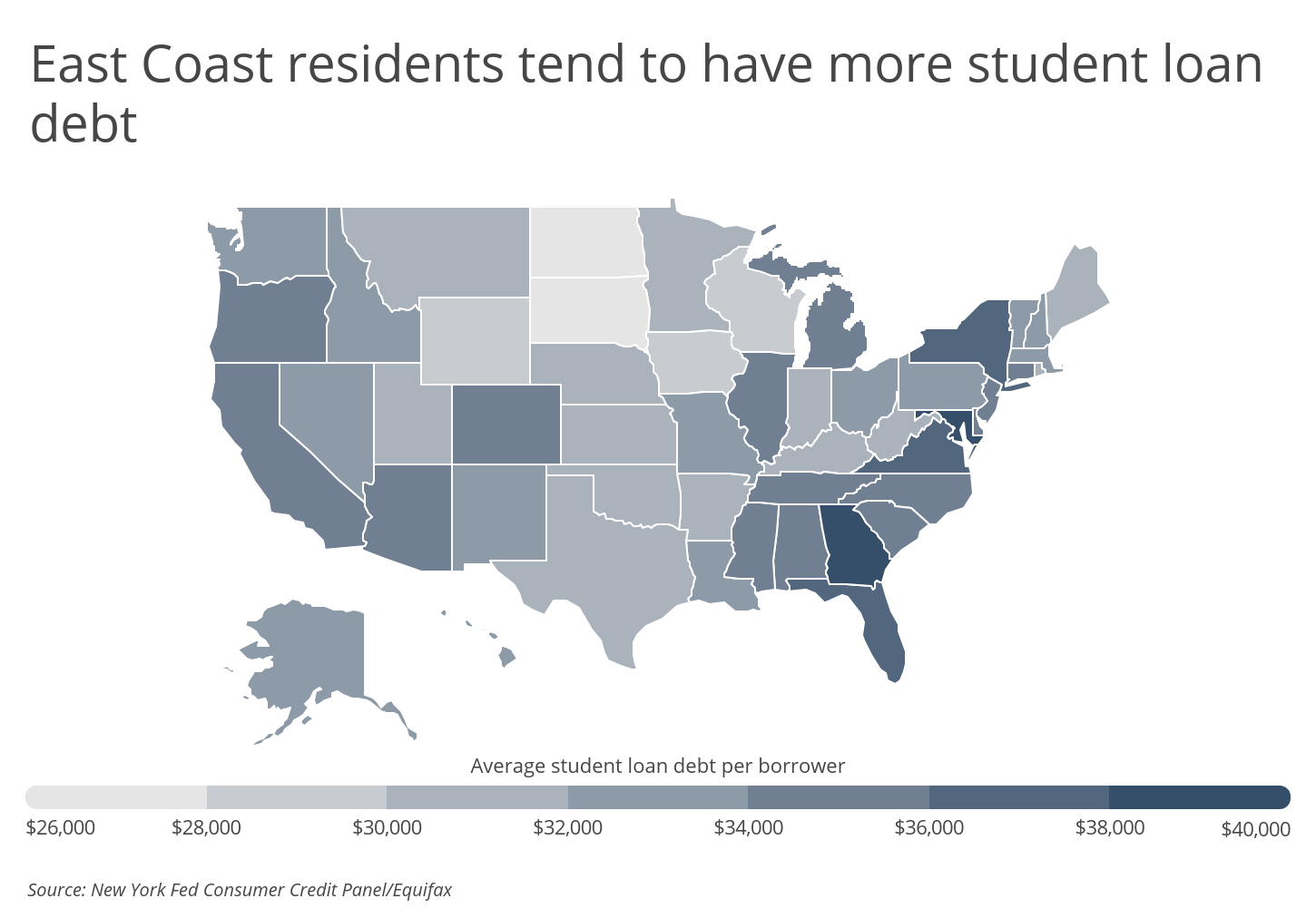

To find where students have been most impacted by the growing student debt problem, researchers at Smartest Dollar ranked states based on the average student loan debt per borrower using data from the Federal Reserve Bank of New York’s Consumer Credit Panel. Researchers chose to use 2019 data (instead of 2020 data) since reporting changes in 2020 stemming from COVID-19 forbearance programs resulted in substantial drops in delinquency rates that were not the result of individuals paying off their loans. As a result, the 2019 data better reflects the actual state of student loan delinquency rates.

The analysis found that borrowers in coastal states tend to have the most student loan debt. While borrowers in California and Oregon have average student loan debts above $35,000, those in the South and East Coast states like Maryland, New York, Georgia, and Virginia have even higher debt burdens.

Here are the states with the most student loan debt per borrower:

States with the greatest student loan debt per borrower

Photo Credit: Alamy Stock Photo

15. Colorado

- Average student loan debt per borrower: $34,800

- Share of borrowers 90+ days delinquent: 13.0%

- Total number of borrowers: 824,300

- Total number of college graduates: 1,768,000

- Total student loan debt (billions): $28.7

TRENDING

Many of the most successful entrepreneurs started their first internet businesses in college. Even if you exclusively reach customers online, it’s still important to have the right insurance. That’s why Smartest Dollar put together a list of the best small business insurance companies and product liability insurance for a wide range of business types.

Photo Credit: Alamy Stock Photo

14. Delaware

- Average student loan debt per borrower: $35,000

- Share of borrowers 90+ days delinquent: 14.1%

- Total number of borrowers: 132,900

- Total number of college graduates: 236,461

- Total student loan debt (billions): $4.7

Photo Credit: Alamy Stock Photo

13. North Carolina

- Average student loan debt per borrower: $35,000

- Share of borrowers 90+ days delinquent: 16.3%

- Total number of borrowers: 1,337,200

- Total number of college graduates: 2,429,699

- Total student loan debt (billions): $46.8

Photo Credit: Alamy Stock Photo

12. New Jersey

- Average student loan debt per borrower: $35,000

- Share of borrowers 90+ days delinquent: 12.2%

- Total number of borrowers: 1,366,000

- Total number of college graduates: 2,692,344

- Total student loan debt (billions): $47.8

Photo Credit: Alamy Stock Photo

11. Mississippi

- Average student loan debt per borrower: $35,200

- Share of borrowers 90+ days delinquent: 22.1%

- Total number of borrowers: 417,900

- Total number of college graduates: 462,014

- Total student loan debt (billions): $14.7

Photo Credit: Alamy Stock Photo

10. South Carolina

- Average student loan debt per borrower: $35,500

- Share of borrowers 90+ days delinquent: 18.7%

- Total number of borrowers: 738,600

- Total number of college graduates: 1,099,135

- Total student loan debt (billions): $26.2

Photo Credit: Alamy Stock Photo

9. Oregon

- Average student loan debt per borrower: $35,600

- Share of borrowers 90+ days delinquent: 15.2%

- Total number of borrowers: 569,800

- Total number of college graduates: 1,071,504

- Total student loan debt (billions): $20.3

Photo Credit: Alamy Stock Photo

8. Alabama

- Average student loan debt per borrower: $35,600

- Share of borrowers 90+ days delinquent: 19.1%

- Total number of borrowers: 606,700

- Total number of college graduates: 920,353

- Total student loan debt (billions): $21.6

Photo Credit: Alamy Stock Photo

7. California

- Average student loan debt per borrower: $35,600

- Share of borrowers 90+ days delinquent: 14.1%

- Total number of borrowers: 4,115,000

- Total number of college graduates: 9,855,894

- Total student loan debt (billions): $146.5

Photo Credit: Alamy Stock Photo

6. Illinois

- Average student loan debt per borrower: $35,900

- Share of borrowers 90+ days delinquent: 12.8%

- Total number of borrowers: 1,757,500

- Total number of college graduates: 3,280,283

- Total student loan debt (billions): $63.1

Photo Credit: Alamy Stock Photo

5. New York

- Average student loan debt per borrower: $36,200

- Share of borrowers 90+ days delinquent: 11.1%

- Total number of borrowers: 2,710,400

- Total number of college graduates: 5,490,898

- Total student loan debt (billions): $98.1

Photo Credit: Alamy Stock Photo

4. Virginia

- Average student loan debt per borrower: $36,600

- Share of borrowers 90+ days delinquent: 13.3%

- Total number of borrowers: 1,176,400

- Total number of college graduates: 2,430,864

- Total student loan debt (billions): $43.1

Photo Credit: Alamy Stock Photo

3. Florida

- Average student loan debt per borrower: $36,700

- Share of borrowers 90+ days delinquent: 17.3%

- Total number of borrowers: 2,617,700

- Total number of college graduates: 4,941,169

- Total student loan debt (billions): $96.1

Photo Credit: Alamy Stock Photo

2. Georgia

- Average student loan debt per borrower: $39,700

- Share of borrowers 90+ days delinquent: 18.2%

- Total number of borrowers: 1,603,900

- Total number of college graduates: 2,404,931

- Total student loan debt (billions): $63.7

Photo Credit: Alamy Stock Photo

1. Maryland

- Average student loan debt per borrower: $41,000

- Share of borrowers 90+ days delinquent: 14.1%

- Total number of borrowers: 887,400

- Total number of college graduates: 1,795,205

- Total student loan debt (billions): $36.4

Methodology & detailed findings

The student loan debt data used in this study is from the Federal Reserve Bank of New York’s Consumer Credit Panel. Researchers chose to use 2019 data (instead of 2020 data) since reporting changes in 2020 stemming from COVID-19 forbearance programs resulted in substantial drops in delinquency rates that were not the result of individuals paying off their loans. As a result, it was determined that the 2019 numbers better reflected the actual state of student loan delinquency rates.

States were ordered based on the average student loan debt per borrower. In the event of a tie, the state with the greater amount of total student loan debt was ranked higher. Data on the number of college graduates by state is from the 2019 American Community Survey.

By clicking the above links, you will go to one of our insurance partners. The specific companies listed above may not be included in our partner's network at this time.