The Best-Paying American Cities for Accountants in 2022

Understanding the complexities of the U.S. tax code can be a challenge for any taxpayer to navigate alone, but major shifts at the federal level in recent years have made the tax landscape even more uncertain.

Under the Trump Administration and a Republican Congress, the Tax Cuts and Jobs Act of 2017 made major changes to the U.S. tax code. The package reduced tax rates for many businesses and individuals and changed a number of deductions and exemptions. But many of the provisions in the law are scheduled to expire over the next few years, potentially reversing the cuts for many U.S. households.

This year, with Democrats in control of Congress and the White House, President Joe Biden signed into law the Inflation Reduction Act. The highlights of the package included more than $700 billion in funding for clean energy and health care projects, but the bill also proposed raising revenue through a 15% corporate minimum tax and new investments in the IRS to collect taxes under the existing code. The White House estimates that increased spending on the IRS will produce savings of $124 billion over ten years.

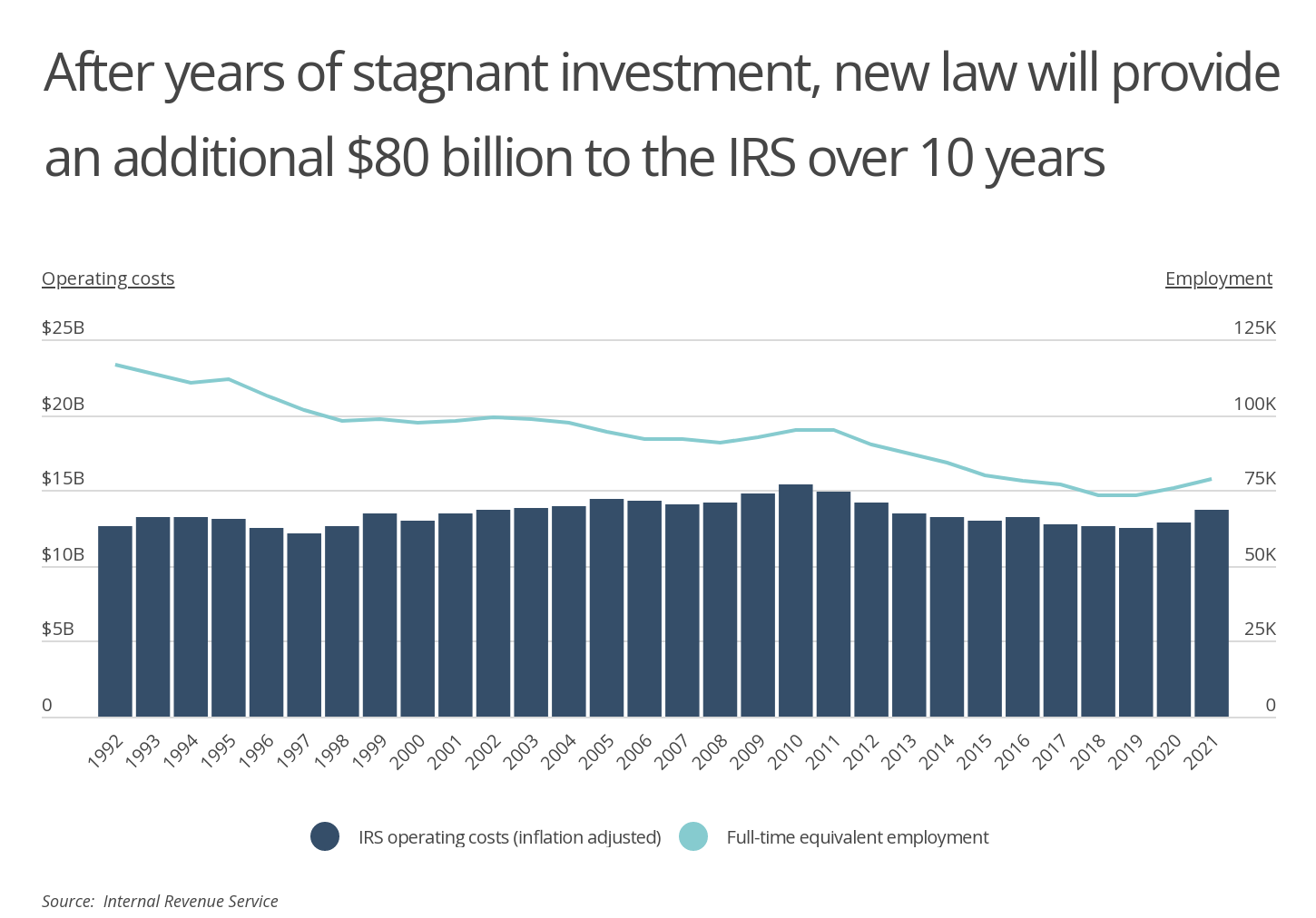

The Inflation Reduction Act’s $80 billion of new investment for the IRS will end a long period of stagnant spending for the agency. Annual spending on the IRS has fallen by 8% in inflation-adjusted dollars over the last 10 years and had been mostly flat for the two decades prior. Over this period, the IRS has seen a significant decline in employment. In 1992, the IRS had a total of 116,673 full-time equivalents, but by 2021, the ranks of employees had fallen to 78,661.

FOR ACCOUNTANTS

Given the nature of their work, accounting firms face high levels of liability risk. A simple mistake on a tax return can result in enormous penalties for their clients. This is why accountants need excellent professional liability insurance, which will provide financial protection in the event of an error or omission that occurs during the course of their work.

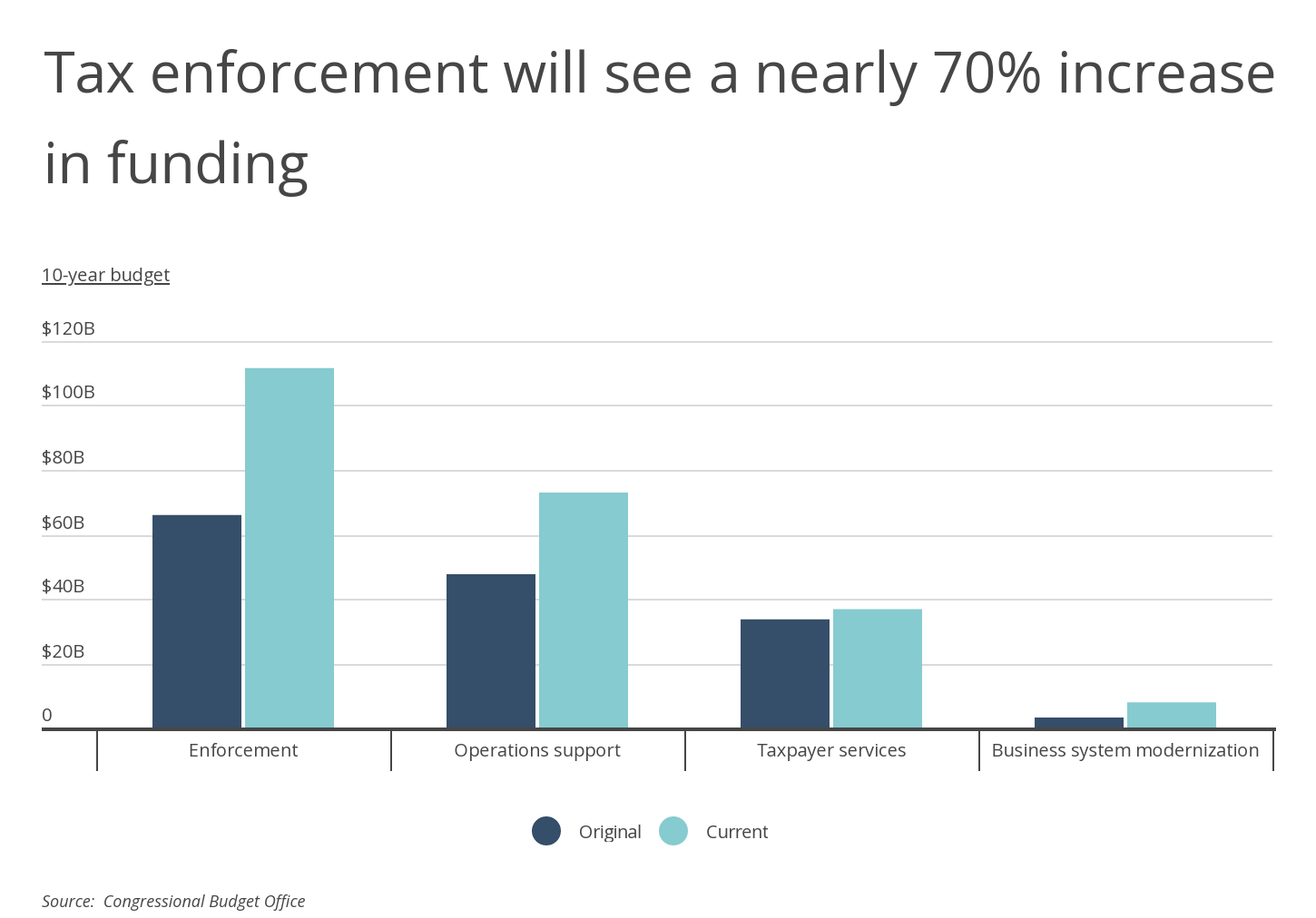

One of the primary areas of added investment under the Inflation Reduction Act for the IRS is enforcement. Funding for tax enforcement over the next decade is slated to grow by nearly 70%, from $66 billion to $112 billion. Much of this additional funding will be used to increase the headcount of IRS agents.

Amid the changing tax code and new efforts to step up enforcement, accountants and auditors may be in greater demand in the near future. Businesses, high earners, and even many regular households may require professional assistance to avoid or address audits and penalties. The Bureau of Labor Statistics cites the complex tax and regulatory environment as a factor likely to drive continued demand in the field, which is expected to grow by 6% over the next decade.

RELATED

An increasingly important insurance policy for firms that handle sensitive client or customer data-like accounting firms-is cyber liability insurance. Cyber insurance will provide financial protection in the event of a data breach or cyber attack that exposes personal data.

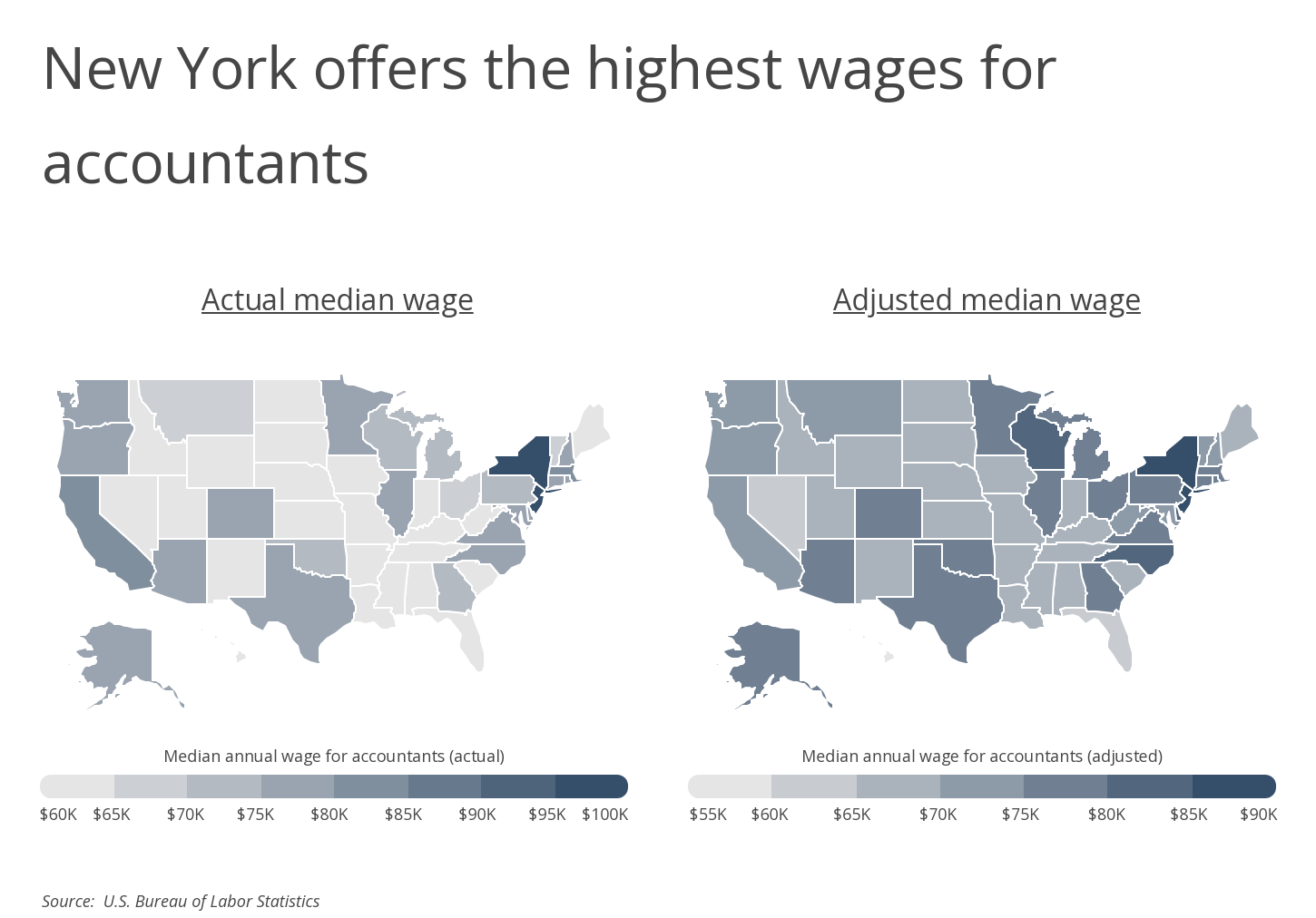

High demand in this environment will also be good for accountants’ earnings. The median accountant in the U.S. earns $77,250 per year, but compensation can vary widely by location. Areas that have many big businesses or high-earning individuals who may have more complex tax needs tend to pay more for accounting services. At the top of this list at the state level is New York, the capital of the financial services industry, where the median accountant earns $97,640 ($88,603 in cost-of-living adjusted earnings).

At the metro level, however, New York City ranks just third on the list of best-paying large metropolitan areas for accountants. Other locations offering high wages include the Bay Area and the D.C. metro. In all of these locations, accountants are in high demand, with concentrations of accountants well above the national average.

The data used in this analysis is from the U.S. Bureau of Labor Statistics and the U.S. Bureau of Economic Analysis. To determine the best-paying locations for accountants, researchers at Smartest Dollar calculated the median annual wage for accountants, adjusted for cost of living. In the event of a tie, the location with the greater actual median annual wage for accountants was ranked higher.

Here are the best-paying U.S. metropolitan areas for accountants.

The Best-Paying Large Metros for Accountants

Photo Credit: Sean Pavone / Shutterstock

15. Houston-The Woodlands-Sugar Land, TX

- Median annual wage for accountants (adjusted): $79,471

- Median annual wage for accountants (actual): $79,550

- Median annual wage for all business and finance jobs (actual): $77,300

- Concentration of accountants (compared to average): +6%

Photo Credit: Sean Pavone / Shutterstock

14. Indianapolis-Carmel-Anderson, IN

- Median annual wage for accountants (adjusted): $79,599

- Median annual wage for accountants (actual): $75,380

- Median annual wage for all business and finance jobs (actual): $63,750

- Concentration of accountants (compared to average): +9%

Photo Credit: f11photo / Shutterstock

13. Detroit-Warren-Dearborn, MI

- Median annual wage for accountants (adjusted): $79,763

- Median annual wage for accountants (actual): $77,450

- Median annual wage for all business and finance jobs (actual): $76,970

- Concentration of accountants (compared to average): +9%

Photo Credit: Sean Pavone / Shutterstock

12. Milwaukee-Waukesha, WI

- Median annual wage for accountants (adjusted): $80,125

- Median annual wage for accountants (actual): $76,840

- Median annual wage for all business and finance jobs (actual): $69,690

- Concentration of accountants (compared to average): +5%

Photo Credit: ESB Professional / Shutterstock

11. Richmond, VA

- Median annual wage for accountants (adjusted): $80,430

- Median annual wage for accountants (actual): $76,730

- Median annual wage for all business and finance jobs (actual): $75,800

- Concentration of accountants (compared to average): +43%

Photo Credit: Open.Tours LLC / Shutterstock

10. Buffalo-Cheektowaga, NY

- Median annual wage for accountants (adjusted): $80,491

- Median annual wage for accountants (actual): $77,030

- Median annual wage for all business and finance jobs (actual): $75,700

- Concentration of accountants (compared to average): +11%

Photo Credit: Sean Pavone / Shutterstock

9. Raleigh-Cary, NC

- Median annual wage for accountants (adjusted): $80,930

- Median annual wage for accountants (actual): $77,450

- Median annual wage for all business and finance jobs (actual): $76,800

- Concentration of accountants (compared to average): +26%

Photo Credit: Sean Pavone / Shutterstock

8. Columbus, OH

- Median annual wage for accountants (adjusted): $81,285

- Median annual wage for accountants (actual): $76,570

- Median annual wage for all business and finance jobs (actual): $69,140

- Concentration of accountants (compared to average): +8%

Photo Credit: f11photo / Shutterstock

7. Cleveland-Elyria, OH

- Median annual wage for accountants (adjusted): $83,065

- Median annual wage for accountants (actual): $77,250

- Median annual wage for all business and finance jobs (actual): $66,360

- Concentration of accountants (compared to average): +10%

Photo Credit: f11photo / Shutterstock

6. San Francisco-Oakland-Berkeley, CA

- Median annual wage for accountants (adjusted): $83,731

- Median annual wage for accountants (actual): $98,300

- Median annual wage for all business and finance jobs (actual): $97,540

- Concentration of accountants (compared to average): +14%

Photo Credit: Sean Pavone / Shutterstock

5. Charlotte-Concord-Gastonia, NC-SC

- Median annual wage for accountants (adjusted): $84,419

- Median annual wage for accountants (actual): $79,860

- Median annual wage for all business and finance jobs (actual): $78,890

- Concentration of accountants (compared to average): +32%

Photo Credit: Valiik30 / Shutterstock

4. Tulsa, OK

- Median annual wage for accountants (adjusted): $84,919

- Median annual wage for accountants (actual): $78,890

- Median annual wage for all business and finance jobs (actual): $63,170

- Concentration of accountants (compared to average): +12%

Photo Credit: dibrova / Shutterstock

3. New York-Newark-Jersey City, NY-NJ-PA

- Median annual wage for accountants (adjusted): $85,645

- Median annual wage for accountants (actual): $98,920

- Median annual wage for all business and finance jobs (actual): $97,870

- Concentration of accountants (compared to average): +45%

Photo Credit: Sean Pavone / Shutterstock

2. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Median annual wage for accountants (adjusted): $85,991

- Median annual wage for accountants (actual): $95,880

- Median annual wage for all business and finance jobs (actual): $97,280

- Concentration of accountants (compared to average): +52%

Photo Credit: Uladzik Kryhin / Shutterstock

1. San Jose-Sunnyvale-Santa Clara, CA

- Median annual wage for accountants (adjusted): $89,563

- Median annual wage for accountants (actual): $100,400

- Median annual wage for all business and finance jobs (actual): $100,940

- Concentration of accountants (compared to average): +38%

Detailed Findings & Methodology

The data used in this analysis is from the U.S. Bureau of Labor Statistics Occupational Employment and Wage Statistics and the U.S. Bureau of Economic Analysis Regional Price Parities datasets. To determine the best-paying locations for accountants, researchers at Smartest Dollar calculated the median annual wage for accountants, adjusted for cost of living. In the event of a tie, the location with the greater actual median annual wage for accountants was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more).

By clicking the above links, you will go to one of our insurance partners. The specific companies listed above may not be included in our partner's network at this time.