Industries Offering the Best Employee Benefits [2022 Edition]

The COVID-19 pandemic brought a number of abrupt changes to the U.S. economy, but some of the most lasting impacts could be in the future of work. From the rise of hybrid and remote work to the Great Resignation to “quiet quitting,” workers have been renegotiating how they work and what they look for in a job over the last two and a half years. And amid continued tightness in the labor market, employers have been forced to respond and make jobs more appealing to current and potential employees.

The Great Resignation is perhaps the most significant trend demonstrating workers’ increased power and mobility since the COVID-19 pandemic began. Many workers were dissatisfied with how employers treated them during the pandemic, from essential workers facing regular exposure to the virus, to white collar professionals feeling burned out by long hours. Others saw opportunities to advance in their careers or have more flexible work arrangements. For all workers, the opportunity to earn more in wages has also been a major driver-especially as inflation has taken hold and eaten into household budgets.

RELATED

As workers gain leverage in the tight labor market, employers face a heightened risk of employment-related lawsuits. Employment practices liability insurance is a form of commercial coverage that protects businesses against such claims.

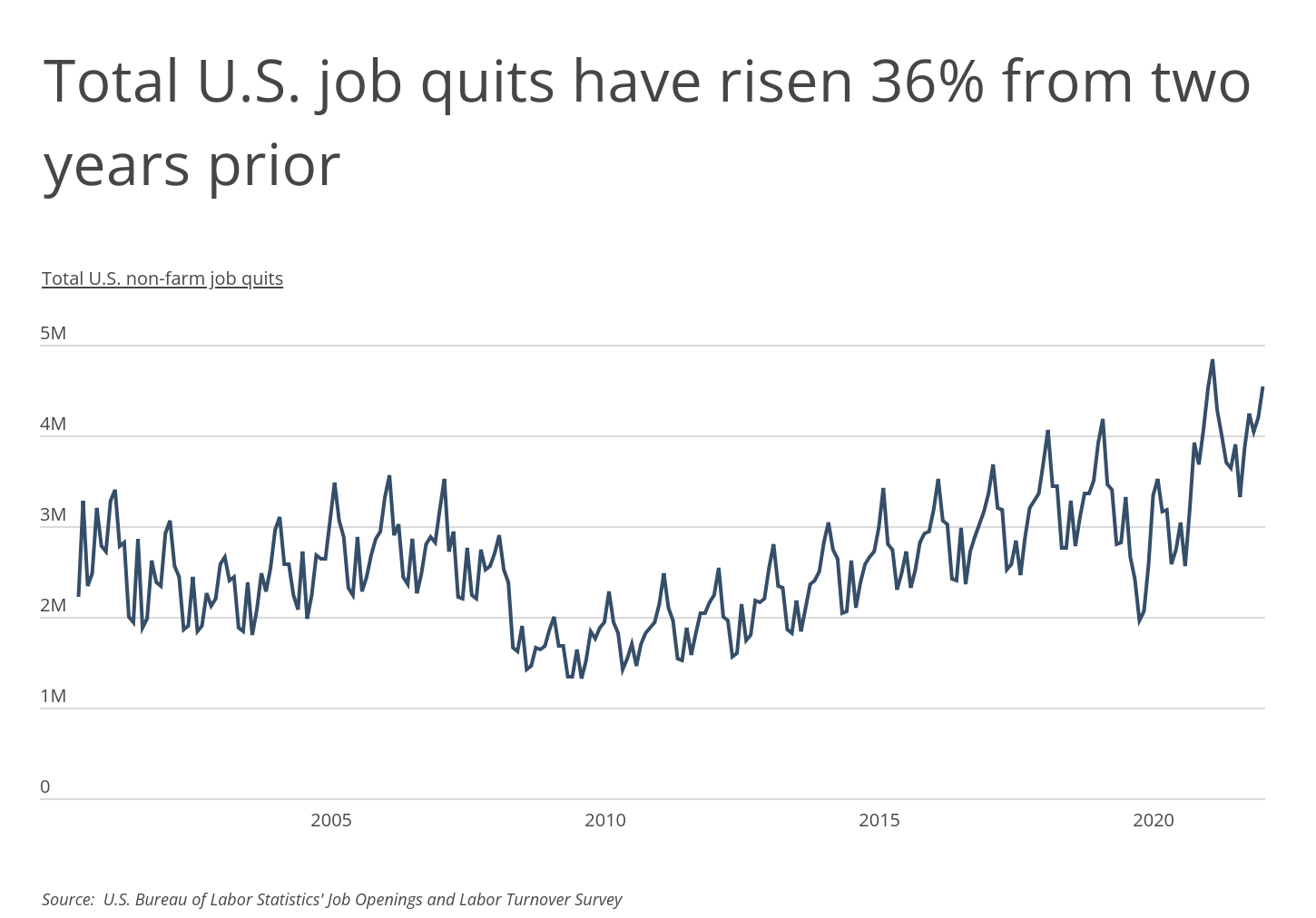

The effect of all these factors has been a significant increase in job movement across the U.S. labor market. Total U.S. job quits began spiking upward in 2021, reaching a high of 4.8 million quits in August 2021. While quits declined slightly in the subsequent fall and winter, workers still left their jobs at rates well above recent historical levels. And in 2022, quits have topped four million in every month from April to July.

While the Great Resignation has affected all industries and income levels, turnover has been most concentrated in low-wage sectors. Fields like retail and hospitality have seen a disproportionate share of the country’s job turnover in the last two years, with workers frequently citing difficult working conditions and low, stagnant wages as a reason for moving on to new roles. These fields are also least likely to offer key benefits like health insurance, paid time off, and flexible work arrangements-all of which took on new importance during the pandemic.

RELATED

In addition to health and life insurance, disability insurance is another common employee benefit that employers offer. According to the BLS, just under half of private industry workers have access to employer-sponsored short-term disability plans.

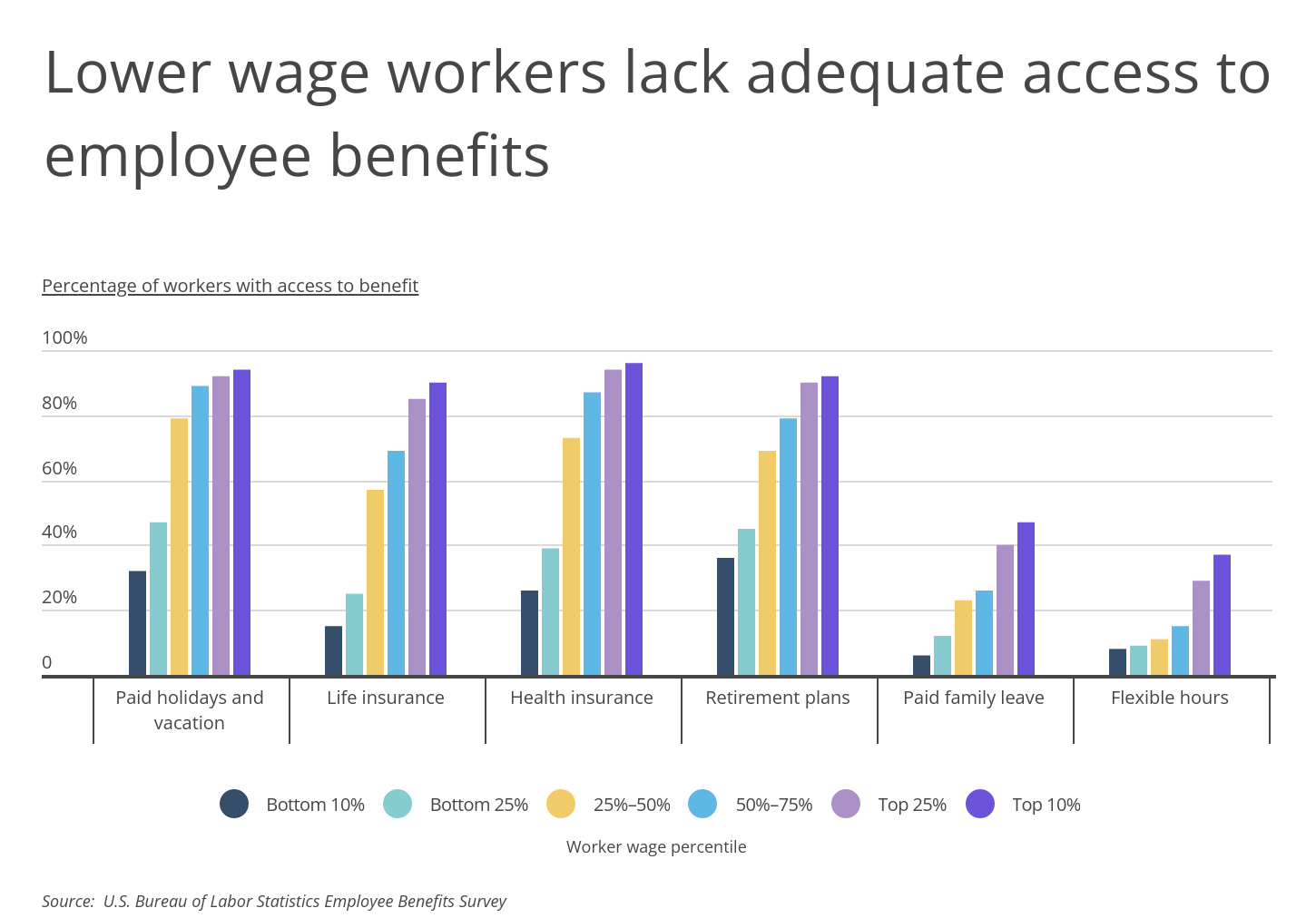

Across all benefit types, access to benefits increases with wages, which means that the lowest earners are least likely to have benefits available. Among the bottom 10% of earners, 36% have retirement plans, 32% have paid holidays and vacation days, 26% have health insurance, and 15% have life insurance, while the share for the top 10% of earners exceeds 90% in each of those categories. Even the gap between low- and middle-income earners can be substantial. For example, just 47% of the bottom quarter of earners have access to paid holidays and vacation days, while 79% of the second-lowest quarter do. Similarly, only 39% of bottom quarter earners have health insurance, compared to 73% of those in the 25–50% wage percentile.

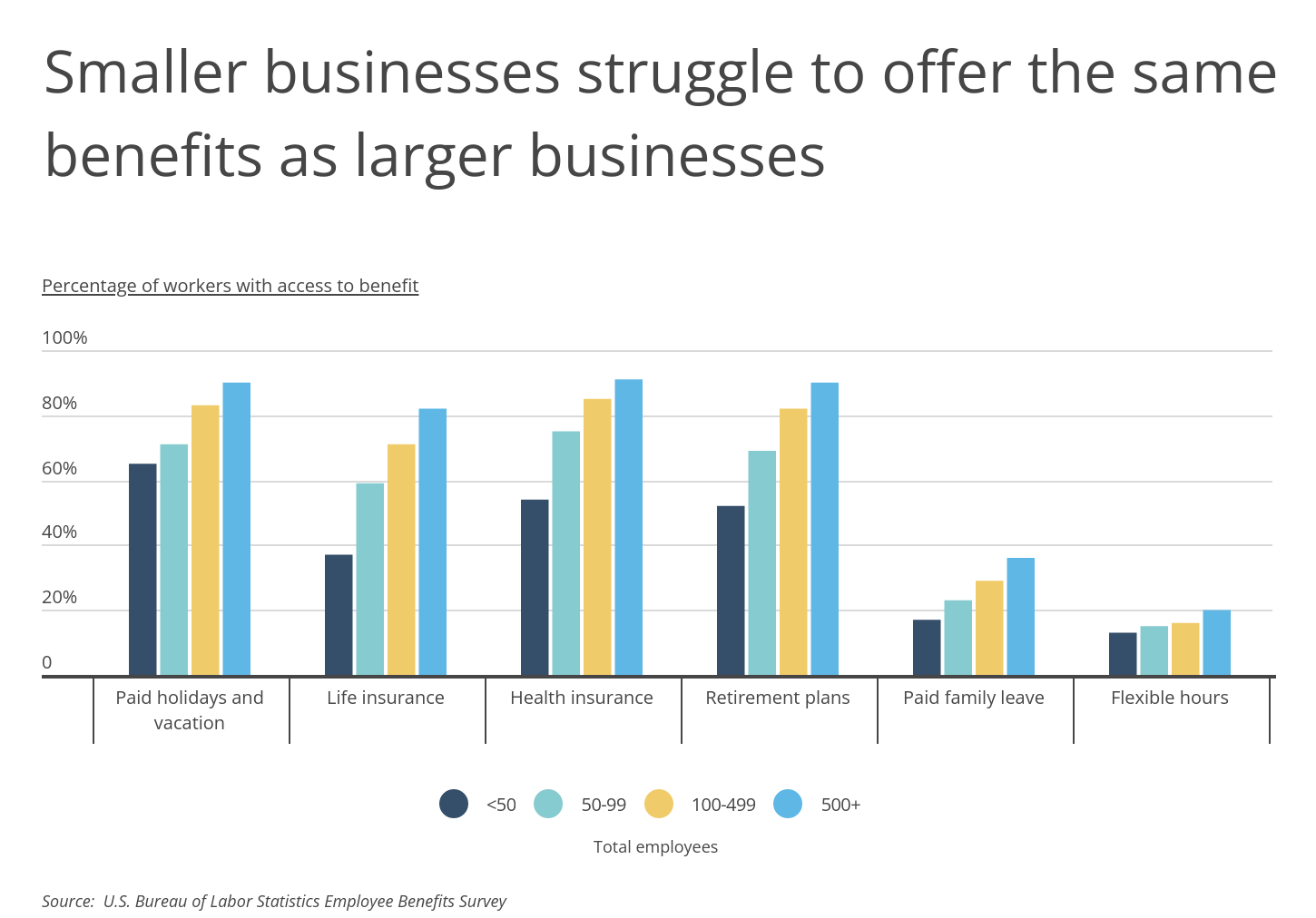

While well-resourced firms have responded to the Great Resignation by raising wages and increasing their benefits offerings, not every employer has been able to do so. Access to benefits has a clear relationship to business size: companies with more employees tend to offer benefits more frequently than companies with fewer employees.

Workers seeking out benefits in their hunt for better jobs and working conditions may also need to look in certain industries to find the employers who are most likely to offer benefits. Typical incomes in a field are one good indicator: high-paying fields like finance and insurance or professional, scientific, and technical services both have among the highest rates of access to benefits. But other industries like utilities and manufacturing also rank highly for benefits. These fields may not pay as highly as white-collar fields, but relatively strong unionization rates and challenging work conditions make it more critical for employers to offer benefits coverage.

The data used in this analysis is from the U.S. Bureau of Labor Statistics. To determine which industries offer the best employee benefits, researchers at Smartest Dollar-an organization that reviews commercial insurance and other business products-calculated a composite score that equally weighted the percentage of private industry workers with access to paid holidays and paid vacation, life insurance, health insurance, retirement plans, paid family leave, and flexible hours. In the event of a tie, the industry with the greater percentage of private industry workers with access to paid holidays and paid vacation was ranked higher.

Here are the U.S. industries offering the best employee benefits.

U.S. Industries Offering the Best Employee Benefits

Photo Credit: Kamil Macniak / Shutterstock

14. Leisure and hospitality

- Composite score: 5.1

- Paid holidays and vacation: 29%

- Life insurance: 17%

- Health insurance: 32%

- Retirement plans: 31%

- Paid family leave: 10%

- Flexible hours: 10%

Photo Credit: SFIO CRACHO / Shutterstock

13. Administrative and support and waste management and remediation services

- Composite score: 16.7

- Paid holidays and vacation: 65%

- Life insurance: 31%

- Health insurance: 54%

- Retirement plans: 43%

- Paid family leave: 13%

- Flexible hours: 10%

Photo Credit: George Rudy / Shutterstock

12. Retail trade

- Composite score: 23.1

- Paid holidays and vacation: 64%

- Life insurance: 41%

- Health insurance: 53%

- Retirement plans: 73%

- Paid family leave: 24%

- Flexible hours: 6%

Photo Credit: afotostock / Shutterstock

11. Construction

- Composite score: 23.1

- Paid holidays and vacation: 75%

- Life insurance: 49%

- Health insurance: 75%

- Retirement plans: 63%

- Paid family leave: 12%

- Flexible hours: 5%

Photo Credit: EHStockphoto / Shutterstock

10. Real estate and rental and leasing

- Composite score: 33.4

- Paid holidays and vacation: 84%

- Life insurance: 60%

- Health insurance: 72%

- Retirement plans: 61%

- Paid family leave: 17%

- Flexible hours: 14%

Photo Credit: Vitpho / Shutterstock

9. Transportation and warehousing

- Composite score: 35.9

- Paid holidays and vacation: 86%

- Life insurance: 69%

- Health insurance: 85%

- Retirement plans: 80%

- Paid family leave: 9%

- Flexible hours: 4%

Photo Credit: wavebreakmedia / Shutterstock

8. Educational services

- Composite score: 37.2

- Paid holidays and vacation: 55%

- Life insurance: 69%

- Health insurance: 73%

- Retirement plans: 72%

- Paid family leave: 30%

- Flexible hours: 11%

Photo Credit: Cryptographer / Shutterstock

7. Health care and social assistance

- Composite score: 51.3

- Paid holidays and vacation: 84%

- Life insurance: 63%

- Health insurance: 78%

- Retirement plans: 74%

- Paid family leave: 29%

- Flexible hours: 15%

Photo Credit: iJeab / Shutterstock

6. Wholesale trade

- Composite score: 62.8

- Paid holidays and vacation: 93%

- Life insurance: 69%

- Health insurance: 89%

- Retirement plans: 83%

- Paid family leave: 25%

- Flexible hours: 14%

Photo Credit: BigPixel Photo / Shutterstock

5. Manufacturing

- Composite score: 68.0

- Paid holidays and vacation: 94%

- Life insurance: 80%

- Health insurance: 90%

- Retirement plans: 84%

- Paid family leave: 23%

- Flexible hours: 11%

Photo Credit: mojo cp / Shutterstock

4. Information

- Composite score: 73.1

- Paid holidays and vacation: 89%

- Life insurance: 78%

- Health insurance: 87%

- Retirement plans: 78%

- Paid family leave: 51%

- Flexible hours: 34%

Photo Credit: Dragon Images / Shutterstock

3. Professional, scientific, and technical services

- Composite score: 78.2

- Paid holidays and vacation: 91%

- Life insurance: 74%

- Health insurance: 89%

- Retirement plans: 85%

- Paid family leave: 41%

- Flexible hours: 46%

Photo Credit: JWPhotoworks / Shutterstock

2. Utilities

- Composite score: 87.2

- Paid holidays and vacation: 99%

- Life insurance: 98%

- Health insurance: 99%

- Retirement plans: 98%

- Paid family leave: 49%

- Flexible hours: 11%

Photo Credit: Zivica Kerkez / Shutterstock

1. Finance and insurance

- Composite score: 92.3

- Paid holidays and vacation: 97%

- Life insurance: 90%

- Health insurance: 94%

- Retirement plans: 93%

- Paid family leave: 50%

- Flexible hours: 38%

Detailed Findings & Methodology

The data used in this analysis is from the U.S. Bureau of Labor Statistics’ 2022 Employee Benefits Survey and Job Openings and Labor Turnover Survey. To determine which industries offer the best employee benefits, researchers at Smartest Dollar calculated a composite score that equally weighted the percentage of private industry workers with access to:

- Paid holidays and paid vacation

- Life insurance

- Health insurance

- Retirement plans

- Paid family leave

- Flexible hours

In the event of a tie, the industry with the greater percentage of private industry workers with access to paid holidays and paid vacation was ranked higher.

By clicking the above links, you will go to one of our insurance partners. The specific companies listed above may not be included in our partner's network at this time.