U.S. Cities Where Pay Is Rising the Fastest [2022 Edition]

On the surface, the economy of the last two years has been extremely favorable to workers. After spiking to nearly 15% early in the COVID-19 pandemic, the unemployment rate today sits around 3.6%. Despite employers’ urgency to hire, labor force participation has been slower to recover, and the “Great Resignation” has workers quitting at historic rates in search of better jobs.

With these factors contributing to a tight labor market, workers have more choice of job opportunities, and more employers have been raising wages to hire and retain employees. As a result, nominal wages are growing faster than at any point in at least two decades.

But rising inflation over the course of 2021 and 2022 has taken a bite out of rising wages. Year-over-year inflation, as measured by the Consumer Price Index, has hovered around or above 8% for much of 2022. Prices for essential expenses like food, shelter, and energy have skyrocketed due to supply challenges. With prices rising so quickly, workers are discovering that their increased pay does not go as far as they had hoped.

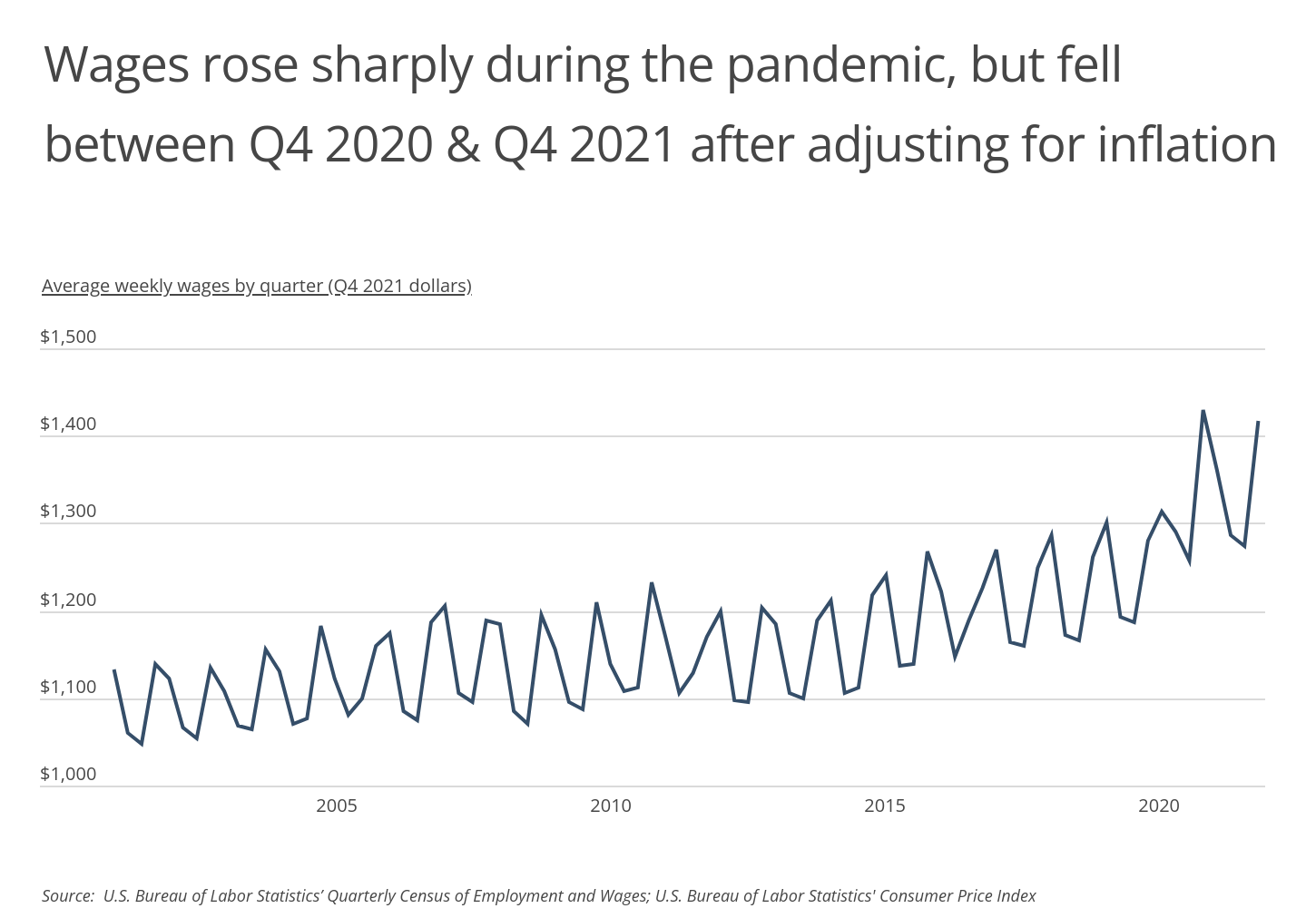

While nominal wages continue to rise to record heights, inflation-adjusted wages have shown signs of decline. In non-adjusted dollars, average weekly wages spiked to $1,339 in the last quarter of 2020 and rose again to $1,418 in the last quarter of 2021. But in inflation-adjusted dollars, wages actually decreased by 0.8% over that span, from $1,429 to $1,418.

RELATED

As an individual makes more in wages, they should consider taking out a life insurance policy, especially if they have dependents. The best life insurance companies offer term policies at affordable rates.

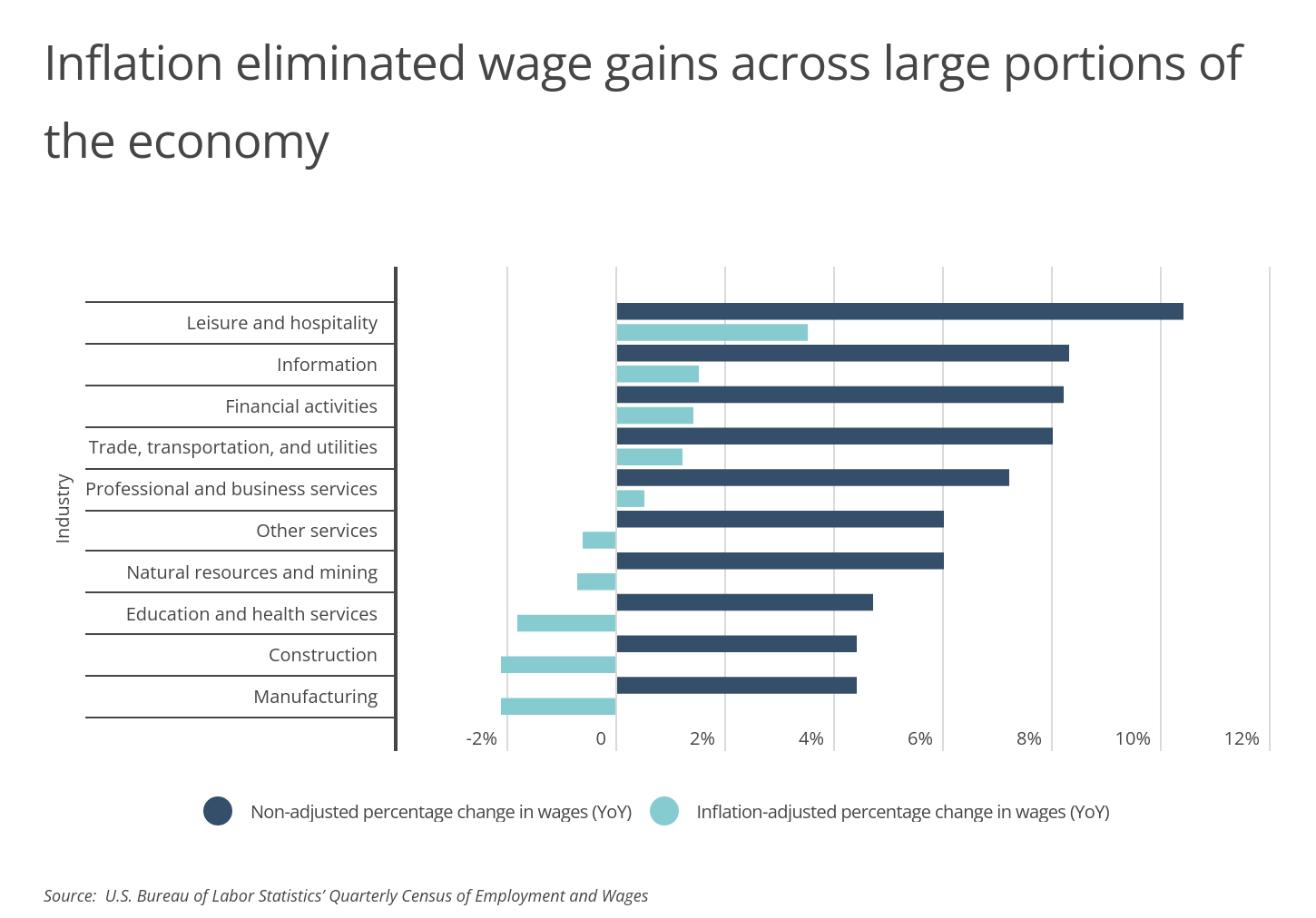

Non-adjusted wage growth looks strong across the economy, but some industries have done a better job keeping pace with inflation than others. Notably, the leisure and hospitality industry-which has felt the effects of the Great Resignation more than any other sector-has been raising wages quickly to keep workers. Leisure and hospitality jobs saw non-adjusted wages increase by more than 10% and adjusted wages increase by 3.5% from the end of 2020 to the end of 2021. But for many other sectors of the economy, inflation has wiped out wage gains completely. Fields including manufacturing, construction, and education and health services all saw declines in inflation-adjusted wages from 2020 to 2021.

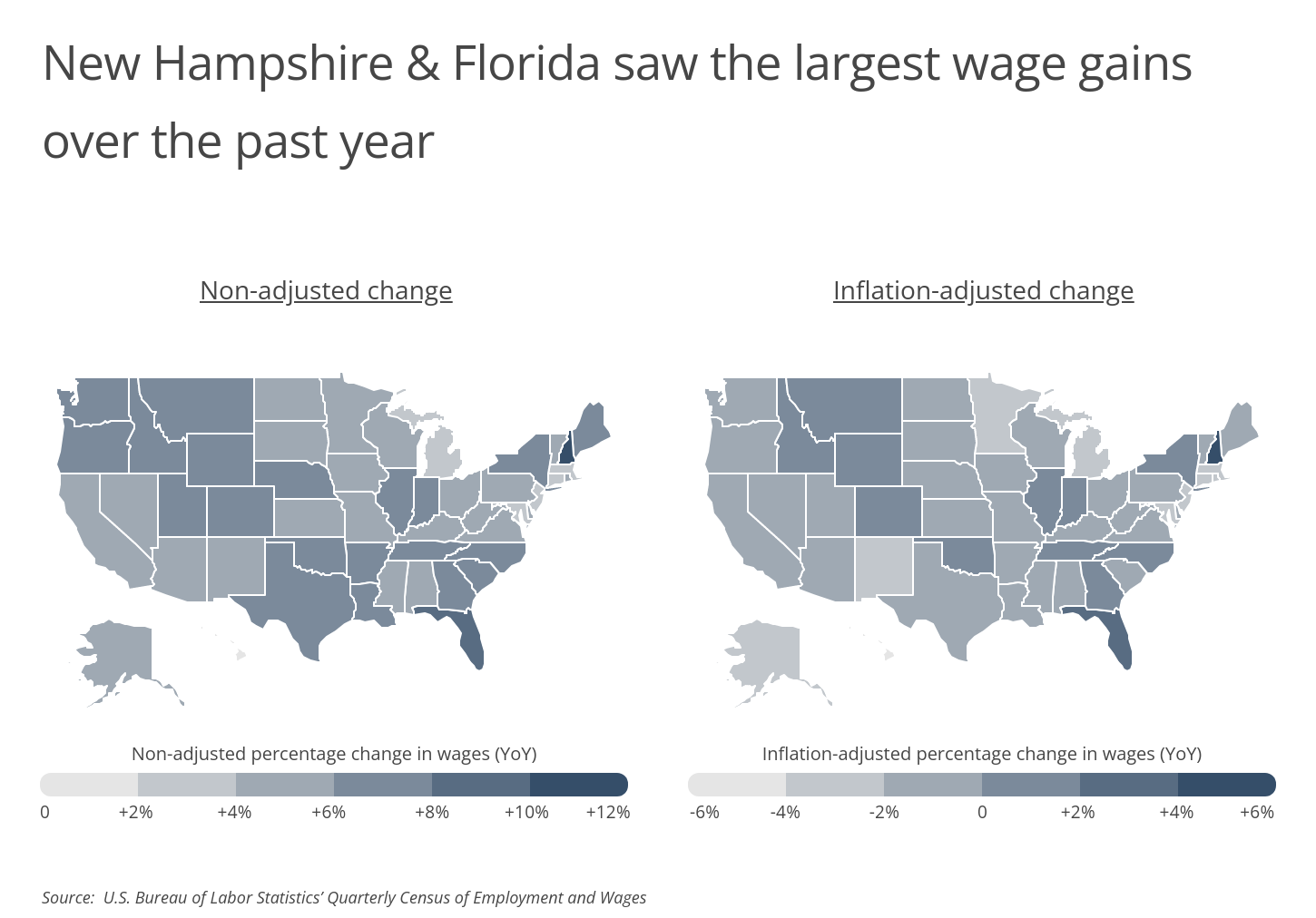

The effects of inflation on wages have also varied by geography. While all 50 states showed at least some increase in non-adjusted wages between 2020 and 2021, only 13 saw a real increase after adjusting for inflation. And among those, New Hampshire (5.2% inflation-adjusted increase) and Florida (2.8%) stand out as the only states whose workers experienced inflation-adjusted wage increases above 1% from the end of 2020 to the end of 2021.

FOR BUSINESS OWNERS

Businesses that manufacture or sell one or more physical products need to have adequate product liability insurance coverage. This form of insurance will cover claims related to products that cause damages to customers.

At the metro level, most of the cities whose workers have fared best in the face of inflation have been booming cities like Raleigh, Denver, Austin, and Nashville. These cities have been attracting workers with thriving economies that offer ample opportunity for good-paying jobs, along with relatively low cost of living compared to many other major cities-two factors that can help in beating inflation.

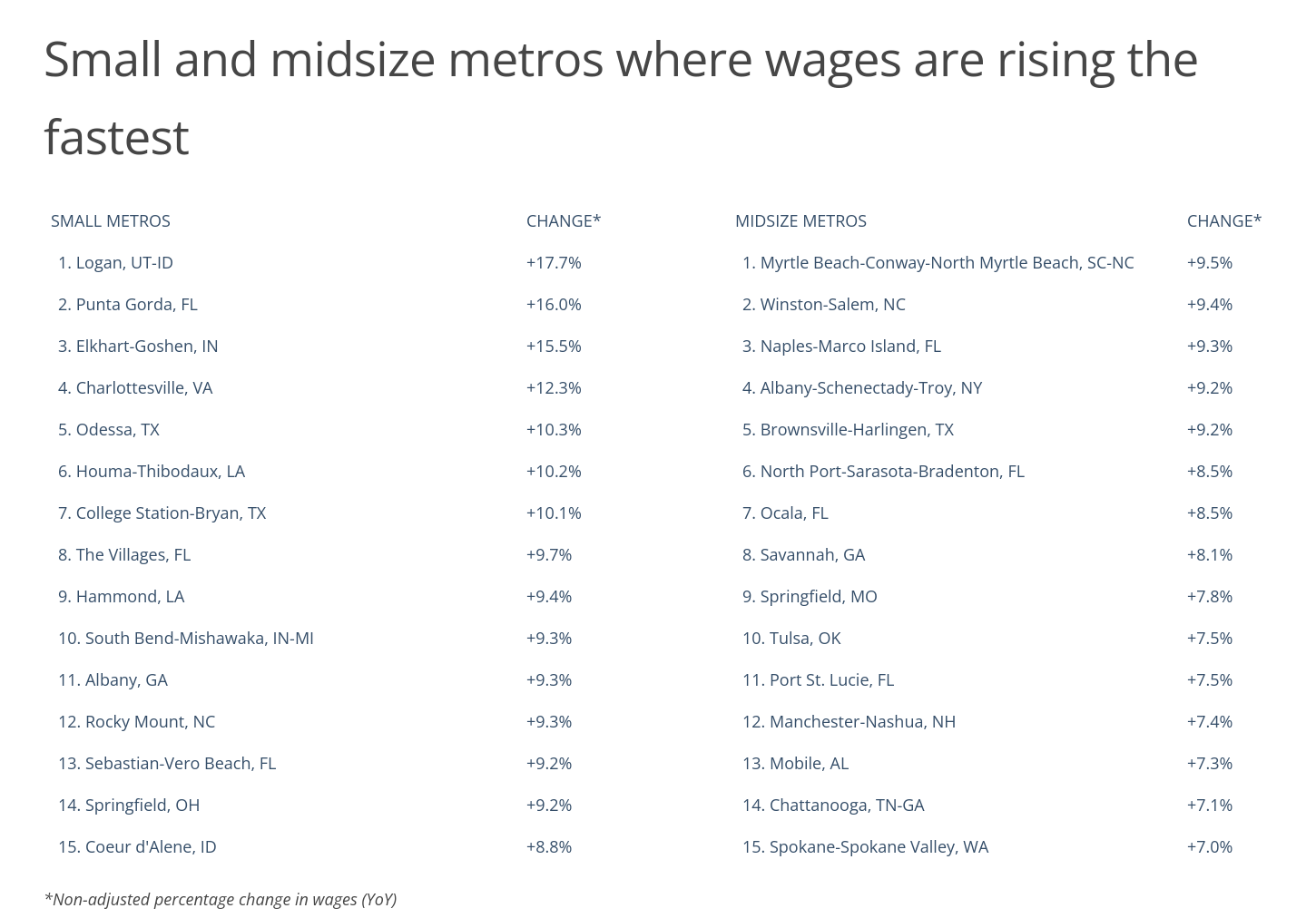

The data used in this analysis is from the U.S. Bureau of Labor Statistics’ Quarterly Census of Employment and Wages. To determine the locations where pay is rising the fastest, researchers at Smartest Dollar-a review website for small business insurance-calculated the non-adjusted percentage change in wages from Quarter 4 of 2020 to Quarter 4 of 2021. In the event of a tie, the location with the greater non-adjusted total change in weekly wages from Quarter 4 of 2020 to Quarter 4 of 2021 was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more). Note: only locations with complete data available during this time period were considered in this analysis.

Here are the U.S. metros where wages are rising fastest.

Large Metros Where Wages Are Rising Fastest

Photo Credit: Sean Pavone / Shutterstock

15. New Orleans-Metairie, LA

- Non-adjusted percentage change in wages (YoY): +6.3%

- Inflation-adjusted percentage change in wages (YoY): -0.4%

- Non-adjusted total change in weekly wages (YoY): +$75

- Average weekly wages Q4 2021: $1,265

- Average weekly wages Q4 2020: $1,190

Photo Credit: mahaloshine / Shutterstock

14. Seattle-Tacoma-Bellevue, WA

- Non-adjusted percentage change in wages (YoY): +6.6%

- Inflation-adjusted percentage change in wages (YoY): -0.1%

- Non-adjusted total change in weekly wages (YoY): +$126

- Average weekly wages Q4 2021: $2,033

- Average weekly wages Q4 2020: $1,907

Photo Credit: Jon Bilous / Shutterstock

13. Charlotte-Concord-Gastonia, NC-SC

- Non-adjusted percentage change in wages (YoY): +6.8%

- Inflation-adjusted percentage change in wages (YoY): +0.1%

- Non-adjusted total change in weekly wages (YoY): +$87

- Average weekly wages Q4 2021: $1,358

- Average weekly wages Q4 2020: $1,271

Photo Credit: f11photo / Shutterstock

12. Atlanta-Sandy Springs-Alpharetta, GA

- Non-adjusted percentage change in wages (YoY): +7.0%

- Inflation-adjusted percentage change in wages (YoY): +0.3%

- Non-adjusted total change in weekly wages (YoY): +$94

- Average weekly wages Q4 2021: $1,436

- Average weekly wages Q4 2020: $1,342

Photo Credit: Rudy Balasko / Shutterstock

11. Cleveland-Elyria, OH

- Non-adjusted percentage change in wages (YoY): +7.1%

- Inflation-adjusted percentage change in wages (YoY): +0.3%

- Non-adjusted total change in weekly wages (YoY): +$87

- Average weekly wages Q4 2021: $1,319

- Average weekly wages Q4 2020: $1,232

Photo Credit: Felix Mizioznikov / Shutterstock

10. Chicago-Naperville-Elgin, IL-IN-WI

- Non-adjusted percentage change in wages (YoY): +7.2%

- Inflation-adjusted percentage change in wages (YoY): +0.4%

- Non-adjusted total change in weekly wages (YoY): +$104

- Average weekly wages Q4 2021: $1,556

- Average weekly wages Q4 2020: $1,452

Photo Credit: photo.ua / Shutterstock

9. Salt Lake City, UT

- Non-adjusted percentage change in wages (YoY): +7.3%

- Inflation-adjusted percentage change in wages (YoY): +0.6%

- Non-adjusted total change in weekly wages (YoY): +$96

- Average weekly wages Q4 2021: $1,407

- Average weekly wages Q4 2020: $1,311

Photo Credit: Songquan Deng / Shutterstock

8. Orlando-Kissimmee-Sanford, FL

- Non-adjusted percentage change in wages (YoY): +8.1%

- Inflation-adjusted percentage change in wages (YoY): +1.3%

- Non-adjusted total change in weekly wages (YoY): +$92

- Average weekly wages Q4 2021: $1,233

- Average weekly wages Q4 2020: $1,141

Photo Credit: Steve Heap / Shutterstock

7. Nashville-Davidson–Murfreesboro–Franklin, TN

- Non-adjusted percentage change in wages (YoY): +8.3%

- Inflation-adjusted percentage change in wages (YoY): +1.5%

- Non-adjusted total change in weekly wages (YoY): +$107

- Average weekly wages Q4 2021: $1,398

- Average weekly wages Q4 2020: $1,291

Photo Credit: Roschetzky Photography / Shutterstock

6. Austin-Round Rock-Georgetown, TX

- Non-adjusted percentage change in wages (YoY): +8.3%

- Inflation-adjusted percentage change in wages (YoY): +1.5%

- Non-adjusted total change in weekly wages (YoY): +$126

- Average weekly wages Q4 2021: $1,635

- Average weekly wages Q4 2020: $1,509

Photo Credit: Sopotnicki / Shutterstock

5. Denver-Aurora-Lakewood, CO

- Non-adjusted percentage change in wages (YoY): +8.4%

- Inflation-adjusted percentage change in wages (YoY): +1.6%

- Non-adjusted total change in weekly wages (YoY): +$127

- Average weekly wages Q4 2021: $1,639

- Average weekly wages Q4 2020: $1,512

Photo Credit: Uladzik Kryhin / Shutterstock

4. San Jose-Sunnyvale-Santa Clara, CA

- Non-adjusted percentage change in wages (YoY): +8.8%

- Inflation-adjusted percentage change in wages (YoY): +2.0%

- Non-adjusted total change in weekly wages (YoY): +$322

- Average weekly wages Q4 2021: $3,961

- Average weekly wages Q4 2020: $3,639

Photo Credit: Bonnie Fink / Shutterstock

3. Tampa-St. Petersburg-Clearwater, FL

- Non-adjusted percentage change in wages (YoY): +9.0%

- Inflation-adjusted percentage change in wages (YoY): +2.2%

- Non-adjusted total change in weekly wages (YoY): +$108

- Average weekly wages Q4 2021: $1,302

- Average weekly wages Q4 2020: $1,194

Photo Credit: Farid Sani / Shutterstock

2. Raleigh-Cary, NC

- Non-adjusted percentage change in wages (YoY): +9.6%

- Inflation-adjusted percentage change in wages (YoY): +2.7%

- Non-adjusted total change in weekly wages (YoY): +$123

- Average weekly wages Q4 2021: $1,405

- Average weekly wages Q4 2020: $1,282

Photo Credit: May Lana / Shutterstock

1. Miami-Fort Lauderdale-Pompano Beach, FL

- Non-adjusted percentage change in wages (YoY): +12.1%

- Inflation-adjusted percentage change in wages (YoY): +5.0%

- Non-adjusted total change in weekly wages (YoY): +$156

- Average weekly wages Q4 2021: $1,446

- Average weekly wages Q4 2020: $1,290

Detailed Findings & Methodology

The data used in this analysis is from the U.S. Bureau of Labor Statistics’ Quarterly Census of Employment and Wages. To determine the locations where pay is rising the fastest, researchers calculated the non-adjusted percentage change in wages from Quarter 4 of 2020 to Quarter 4 of 2021. In the event of a tie, the location with the greater non-adjusted total change in weekly wages from Quarter 4 of 2020 to Quarter 4 of 2021 was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more). Note: only locations with complete data available during this time period were considered in this analysis.

By clicking the above links, you will go to one of our insurance partners. The specific companies listed above may not be included in our partner's network at this time.